I often times get asked, “Why would you want to strive for a good credit score if you don’t plan on borrowing money?” When I speak within the community.

Having good credit does not only affect you in the lending world, it also affects many other aspects of your life. These are services that many of us need and having a higher score will save us money. Here are a few reasons to have good credit.

INSURANCE PREMIUMS FOR YOUR HOME AND CAR. When you call around for insurance rates the representative will usually ask for your social security number for a credit check. They will quote you a rate partially based on your credit score. The higher the score the lower your premium and vice versa. You could end up saving yourself hundreds of dollars or more a year just by increasing your credit score. If you don’t have a high credit score now but work on it this next year, have your insurance company reevaluate your plan for a cheaper premium once your score has improved.

GETTING APPROVED TO RENT THE HOME OR APARTMENT YOU ACTUALLY WANT TO LIVE IN. Each leasing company has their own guidelines for their properties. The high end properties with more amenities will probably require you to have a higher credit score, possibly 700 or higher. If you do not meet that requirement you may end up paying a higher deposit, paying several months rent upfront, or they may not rent to you at all. It is very disappointing to have your heart set on a certain place to live and find out you are not approved and having to look elsewhere.

EMPLOYERS AND FUTURE EMPLOYERS CAN CHECK YOUR CREDIT REPORT WITH YOUR PERMISSION. This is usually a practice for management positions, human resources, if you will be giving financial advice, and so on. If you are seeking a new job or a new position within your company they may request to view your credit report. If you refuse, it could be a red flag and they may choose another candidate that was cooperative. Even if you do have some blemishes on your credit, it doesn’t mean you won’t get the job. Be open and honest with the employer. According to the Society for Human Resource Management, credit history ranked lowest among criteria employers used to vet candidates.

ENTERING INTO A CELL PHONE CONTRACT OR CABLE/SATELLITE CONTRACT. Most of these companies check your credit score before letting you enter into a contract and if it is on the low end they usually require you to pay a deposit of a couple hundred dollars. If you had a good credit score you would not have to pay any money upfront.

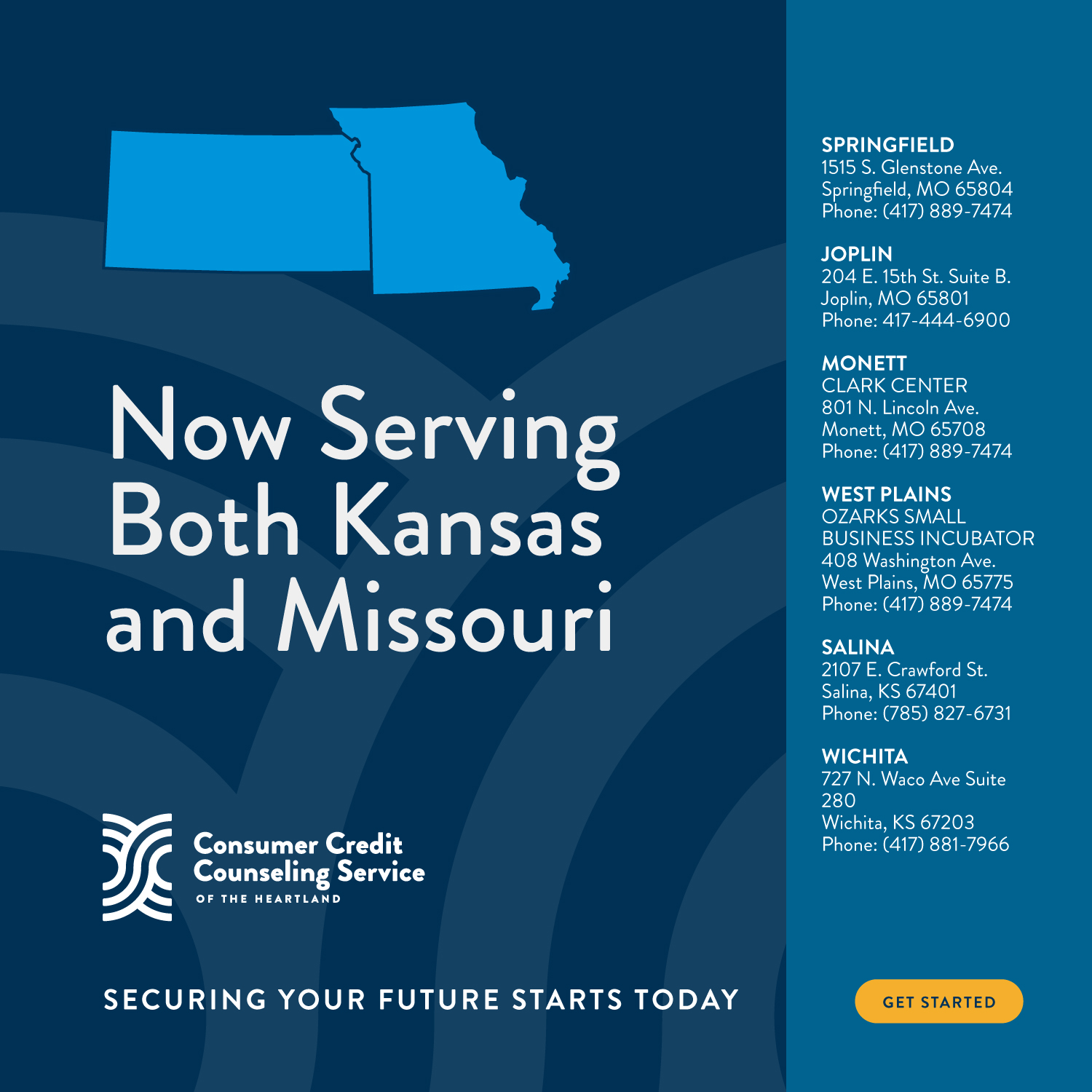

We have trained counselors at Consumer Credit Counseling that can review your credit report with you and put you in the right direction. Improving your credit does take time and commitment but it is worth it for many aspects of your financial life.

To check your credit report for free go to www.annualcreditreport.com

Written by Beth Mincks, Consumer Credit Counseling Service of the Heartlands