Saving money doesn’t have to be so difficult when you have a goal.

When it comes to saving money, we all have different reasons. One common denominator is that it takes discipline and motivation. Unfortunately there are too many people that do not save money and use expensive routes, such as payday or title loans, or have to rely on family when an emergency arises. I also see people that miss out on “life” because they don’t save for the things they love.

Here are some examples that would motivate someone to save money:

- Emergencies

Too often people believe that “It won’t happen to me”. Then when an emergency does arise, they have a deer in the headlights look and go into panic mode. When we go into panic mode, we tend to make unwise decisions. The solution to this scenario is to figure out how much you feel you should save in your emergency fund and start saving to reach that goal. It probably won’t happen within a few months and it may take years but at least you have something to fall back on. - Vacations

Everyone needs time away or to experience a different atmosphere than what they are exposed to day in and day out. Using a credit card to fund your vacation is not the best choice because it can take some time to pay back and you are charged interest each month. You end up paying a lot more than what the vacation actually cost. Plus by the time you pay the card off, you want to go on another vacation which more than likely will go on the credit card. A solution is to save a little each month to be able to pay for your vacation entirely. When you get home and continue your busy life again, you don’t have the added stress of having to pay off your vacation. - Vehicles

Financing your vehicle is so normal these days and it is something we feel we need to do in order to have the cars or trucks we want. A car payment can be a good chunk of your budget, especially if both parties in the household have one. The kicker is, when you finally pay the car off, you are ready for a new one. What if you are ready for a new one before it is paid off? You roll the loan into the new car and now owe much more than the car is actually worth. A solution could be to drive an inexpensive vehicle for however long you need to, make sure you have a mechanic check it out before you buy it. Drive that car and save what you would have been paying on a car payment each month. Put that money into a CD or a mutual fund to accrue more interest than a traditional savings account. When you are ready, you can buy the car you love outright.

There are many more reasons to save money but having an emergency fund, being able to get away, and keeping our expenses low gives us financial peace. Our lives are stressful enough, why make it worse by living paycheck to paycheck?

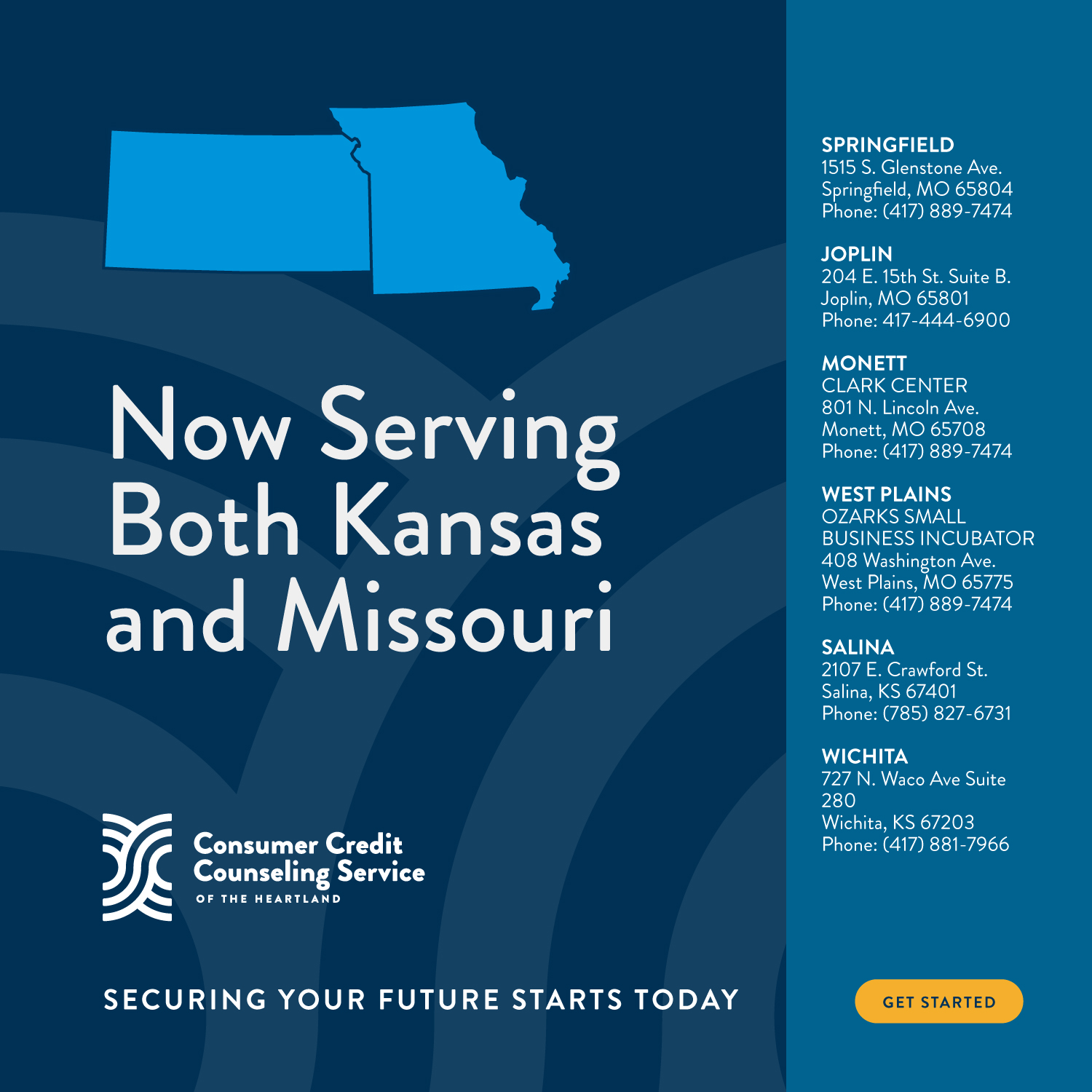

Written By Beth Mincks, Consumer Credit Counseling, Springfield, Mo.

CCCS of the Heartland is a local non-profit.