Beginning in April 2011 federal banking regulators issued enforcement actions against several large federally regulated mortgage servicing companies. Yep, you know its bad when the feds take this kind of action.

What did these mortgage servicing companies do? The politically correct answer goes something like this..” mortgage servicing companies will have to correct deficient mortgage servicing and foreclosure processes and identify borrowers who were harmed by foreclosure errors..”. More commonly this means that millions of people struggling to stay in their home were told by their mortgage servicing company that they could apply for workout assistance only to be drawn into a cycle of sending financial documents to the mortgage servicer repeatedly, not getting return phone calls from their assigned agent and all the while trying to do the right thing to keep their home only to lose a battle that wasn’t even fairly fought.

So along comes the IFR or Independent Foreclosure Review process. The numbers pan out like this:13 mortgage servicing companies, 4.2 million mortgage borrowers affected and, are you ready for the big number, 9.3 Billion dollar settlement. Of which, 3.6 Billion has been set aside for cash payment to borrowers harmed as a result of deficient mortgage servicing and foreclosure processess.

Listen up then, if your lost your home to foreclosure between January 1, 2009 through December 31, 2010 and receive a postcard or letter in the mail from the Independent Forecloure Reivew or Rust Consulting it is legitimate and your should take advantage of this opportunity. The link to the Independent Foreclosure Review website is https://independentforeclosurereview.com/. It’s the only one to be used.

Rust Consulting will begin contacting borrowers previously identified by the mortgage servicing companies by the end of March 2013.

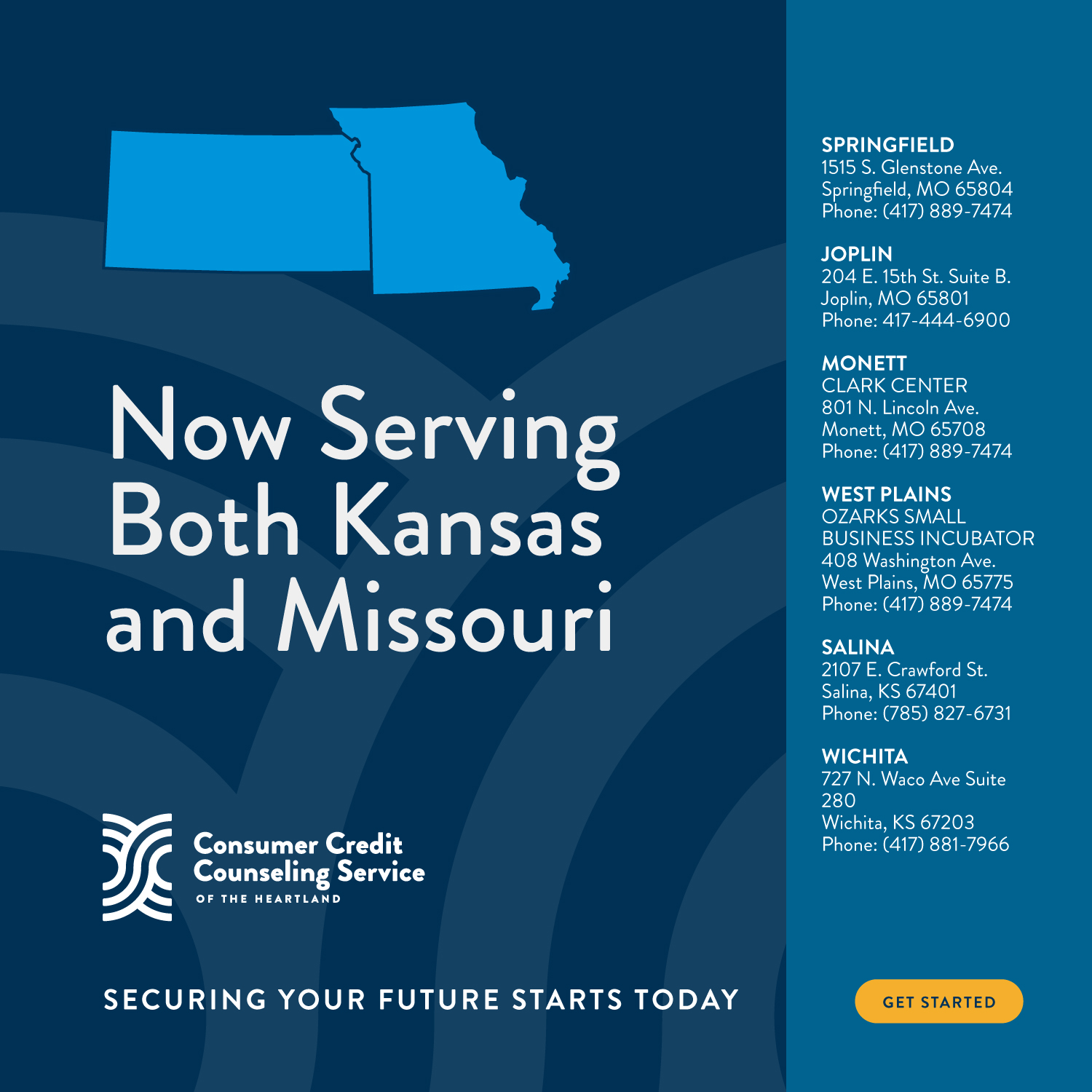

As always, if you have questions, CCCS is here to help.