According to the National Foundation for Credit Counseling’s (NFCC) recent Financial Literacy Survey, many consumers have misperceptions about credit counseling agencies, causing confusion that is preventing them from reaching out for the help they need.

NFCC Member Agencies are required to be accredited by an independent third party, and all counselors must become certified. Additionally, members must adhere to the NFCC’s stringent Member Quality Standards, thus setting members apart from others in the sector.

The survey revealed the following examples of the confusion associated with credit counseling:

Respondents did not know which agency to turn to for assistance.

- FACT: It is smart to be cautious, particularly when dealing with financial matters, but it is not smart to let confusion be an impediment to getting assistance. To find legitimate help, consumers should look for an agency associated with a membership organization such as the NFCC, then check with the Better Business Bureau and their state Attorney General’s office, looking for unresolved complaints against any agency they are considering.

Many thought credit counseling cost too much.

- FACT: The truth is that counseling through an NFCC Member Agency is either free or low cost. One of the NFCC’s Member Quality Standards is that no service can be denied based on an inability to pay. Therefore, in cases of true hardship, the fee will be waived.

Some believed credit counseling would hurt their credit report and credit score.

- FACT: NFCC Member Agencies do not report to the credit bureaus. Actually, many clients’ credit scores improve after credit counseling or by utilizing a Debt Management Program (DMP), as payments become consistent and debt decreases. As an example, the NFCC’s 2012 Clients of the Year recently paid off their house and bought their first new car.

Others felt that credit counseling agencies only offered advice, not real solutions.

- FACT: The goal of the counselor is to provide both short-term and long-term solutions for consumers. Each person is provided with a written Action Plan which provides concrete steps that address immediate concerns and lay the groundwork for a financially stable tomorrow. The Debt Management Plan is an example of one solution that may be offered. When utilizing this tool, the counselor negotiates with the creditor for a lower monthly payment, a lower interest rate, and late fees and over-limit fees stopped or lowered. Once in place, the DMP provides immediate relief for those struggling to meet debt obligations.

Some thought that debt settlement or bankruptcy were better or easier options.

- FACT: Debt settlement and bankruptcy are both serious financial decisions, and typically have negative consequences for a person’s credit report and score. They may be the right answer for some situations, but should only be considered after having first reviewed all other resolution options.

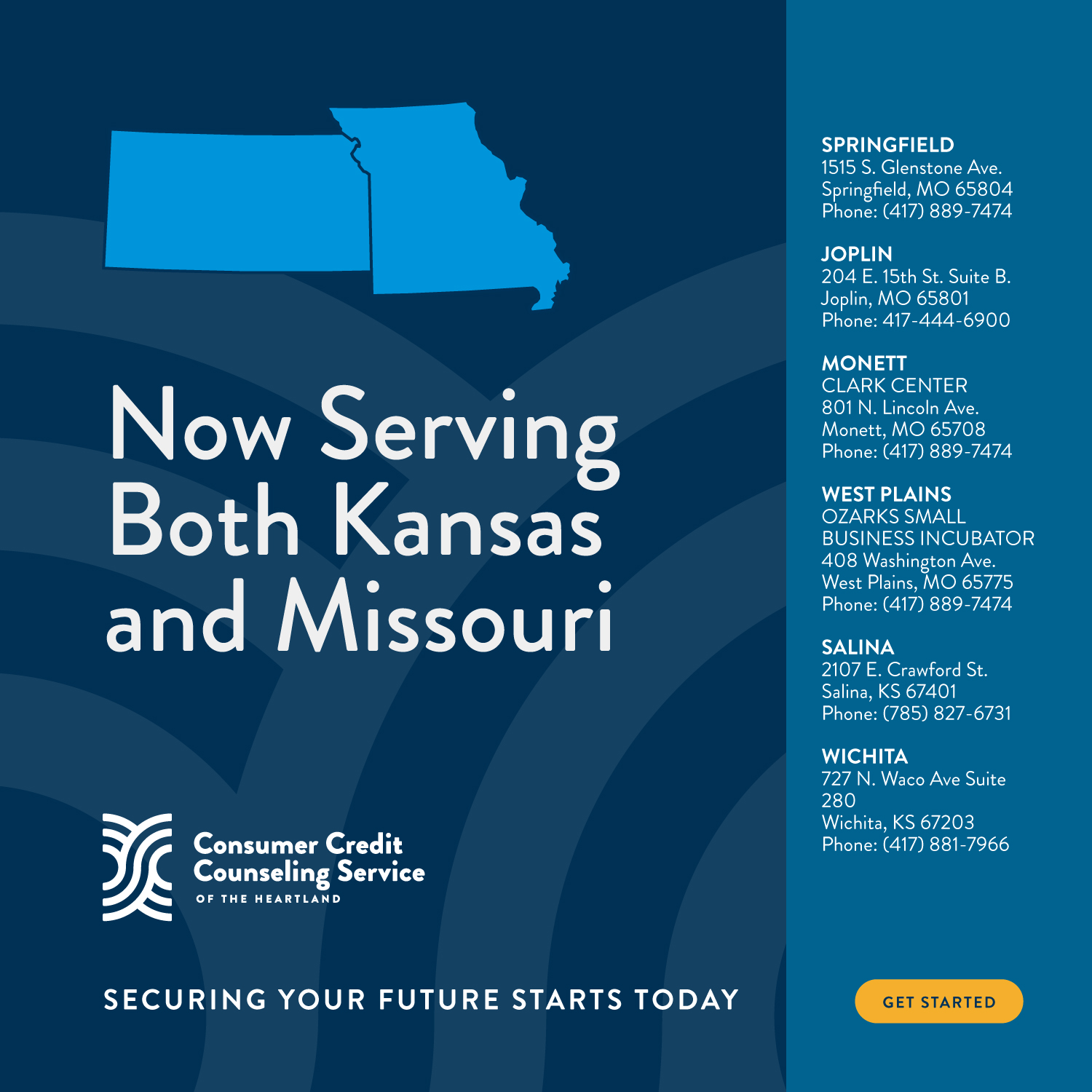

Learn more about our online counseling services today and take action with any financial setbacks you’re experiencing. Waiting too long may make matters worse. CCCS of Springfield, Mo. is located on 1515 S. Glenstone Ave. and we can be reached at 417-889-7474 to schedule a free counseling session.